Getting a handle on the Gig of Home Insurance Assessors: Safeguarding Your Endeavor

Introduction:

Homeownership goes with a swarm of commitments, and one crucial perspective is protecting your theory through broad home insurance. If there should be an occurrence of unexpected circumstances like horrendous occasions, incidents, or thefts, having a reliable home insurance procedure is key. To conclude the consideration and compensation in case of a case, home insurance assessors expect a basic part.

-

The Occupation of Home Insurance Assessors:

Home insurance assessors are specialists depending on assessing the mischief to property and choosing the level of consideration in the event of a case. Their fundamental commitment is to impartially survey the damage or loss and give an exact check of the upkeep or replacement costs. These evaluations are essential for insurance associations to think about claims capably and ensure policyholders get fair compensation.

-

Meaning of Home Insurance Assessors:

Home insurance assessors are ready to coordinate cautious examinations, taking into account all pieces of the damage. This exactness is fundamental in unequivocally concluding how much compensation the policyholder is equipped for, avoiding questions or errors.

As fair specialists, home insurance assessor works for both the insurance association and the policyholder. Their responsibility is to ensure a fair and unbiased objective for the two players, helping homeowners get the money-related assistance they expect to restore their property.

Home insurance assessors have all-around data on improvement, property valuation, and the cost of materials and work. This expertise licenses them to give exact assessments, supporting insurance associations in pursuing informed decisions on claims.

-

The Cases Communication and Home Insurance Assessors:

Exactly when a homeowner experiences hurt covered by their insurance procedure, the underlying step is to record a case with their insurance association. This starts the case collaboration, and an insurance specialist, often a home insurance assessor, is given a mission to study the mischief.

The home insurance assessor coordinates a cautious assessment of the property, recording the level of the mischief and collecting information essential for the case cycle. They could take photographs, collect spectator announcements, and review material documentation.

Considering their assessment, the home insurance assessor gives an organized check of the upkeep or replacement costs. This information is then used by the insurance association to conclude the reasonable compensation aggregate. The goal is to restore the property to its pre-hurt condition.

-

Challenges Looked by Home Insurance Assessors:

Assessing property mischief can occasionally incorporate close-to-home judgment, especially about assessing the level of mileage. Home insurance assessors ought to investigate this subjectivity to give a fair and impartial assessment.

With movements being developed materials and practices, home insurance assessors ought to stay revived on industry designs. This ensures their assessments unequivocally reflect the continuous costs of fixes or replacements.

-

Development’s Impact on Home Insurance Examinations:

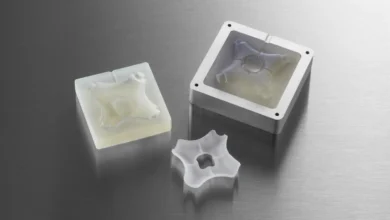

Current home insurance assessors impact progressed instruments, similar to robots and 3D showing programming, to overhaul the accuracy of their examinations. These headways give a more complete point of view on the property and help in careful damage evaluation.

Advancement similarly works with predictable correspondence between assessors, insurance associations, and homeowners. This deals with the capability of the case cycle, diminishing delays and ensuring helpful objectives.

Conclusion:

Home insurance assessors accept a pressing part in the overall insurance climate, going probably as impartial experts who conquer any issues among homeowners and insurance associations. Their fussy evaluations add to fair compensation, ensuring that policyholders can restore their homes after amazing events.

FAQs:

Q1: What capacities truth be told do home insurance assessors have?

A1: Home insurance assessors routinely have insight into improvement, designing, or an associated field. They go through specific arrangements and may hold declarations in property assessment and insurance.

Q2: How does the home insurance assessment deal with requirements?

A2: The range of the evaluation cycle varies depending on the level of the mischief. Overall, it could require several days to a little while for a comprehensive evaluation and appraisal of fix or replacement costs.

Q3: Power I anytime banter the assessment given by a home insurance assessor?

A3: To be sure, homeowners save the choice to scrutinize the assessment assuming they acknowledge it is off-base. Insurance associations much of the time have a solicitations communication, allowing policyholders to give additional evidence or search briefly evaluation to ensure a fair objective.